FPAM Digest – Sept 2024 Issue

September 14, 2024

Yay, Celebrating The New Stamp Duty Rates for Assignment of Insurance Policy and Takaful!

October 30, 2024In today’s fast-paced world, financial stability and security have become essential priorities for individuals and families alike. Yet, guiding clients through the complexities of personal finance requires more than just a basic understanding of budgeting and saving—it demands a comprehensive grasp of financial principles, investment strategies, tax laws, retirement planning, and much more. As someone considering the Certified Financial Planner or CFP certification, you’ll soon learn that real-world financial planning involves far more than advising on single issues; it’s about addressing the full spectrum of a client’s financial life.

As a CFP professional, your role extends beyond managing a single individual’s finances. You will often navigate the financial needs of entire families, plan for legacies, manage estates, and consider complex scenarios involving business interests, multiple assets and liabilities, existing loans, and other financial commitments. Your mission as a financial planner is to bring clarity, strategic thinking, and a holistic approach to these multifaceted situations, providing clients with guidance that truly aligns with their goals and values.

Becoming a CFP professional is about embracing a career where you can empower others with the knowledge and resources they need to make informed decisions about their financial futures. It’s about equipping yourself with the expertise to look beyond the surface of financial statements and to truly understand the broader implications of every financial decision your clients make. As a CFP professional, you position yourself at the forefront of a vital industry, ready to make a meaningful impact by guiding individuals towards financial confidence and success.

Why the CFP Certification Matters

The CFP designation is recognized globally as the benchmark of excellence in financial planning. It signifies your commitment to the highest standards of competency, ethics, and professionalism. As a CFP practitioner, you are part of a community that values continuous learning and strives to make financial planning accessible and understandable for everyone. The CFP mark is a testament to your dedication to helping clients achieve their dreams, secure their futures, and shape legacies that last beyond their lifetimes.

The Growing Demand for CFP Professionals

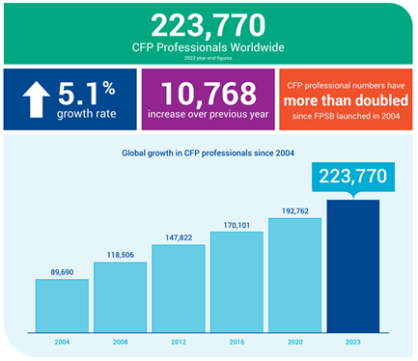

The financial planning profession is growing rapidly as more people recognize the need for professional advice in managing their finances. According to the Financial Planning Standards Board (FPSB), the number of CFP professionals worldwide reached 223,770 by the end of 2023, reflecting a 5.1% increase from the previous year. This upward trend demonstrates the increasing value and demand for CFP professionals, as more individuals seek expert guidance to navigate their financial journeys.

Source: Financial Planning Standards Board (FPSB)

With more than 50% of people who have never received financial planning advice planning to seek it within the next three years, the need for qualified CFP professionals is more apparent than ever. The growth of the CFP community means more people around the world will have access to professionals who adhere to rigorous standards of ethics and practice, ensuring they receive the highest quality of advice.

The Benefits of Becoming a CFP Professional

- Comprehensive Expertise: The CFP certification program provides you with in-depth knowledge across all aspects of financial planning, including investment, estate, tax planning, and risk management. This comprehensive skill set enables you to address the varied and complex needs of your clients with confidence.

- Enhanced Credibility: Earning the CFP designation sets you apart as a trusted professional in the financial planning industry. It communicates to clients and employers that you have met the stringent education, examination, experience, and ethical requirements that define the CFP mark.

- Career Flexibility and Opportunities: As a CFP professional, you have the flexibility to shape your career in a way that aligns with your interests, whether that’s working independently, joining a financial services firm, or specializing in niche areas like retirement or estate planning. The CFP designation opens doors to diverse opportunities both locally and internationally.

- Commitment to Continuous Learning: The financial landscape is always evolving, and as a CFP certificant, you are committed to staying up-to-date with the latest industry developments through ongoing education. This dedication to lifelong learning not only enhances your professional growth but also ensures you continue to provide the best possible service to your clients.

- Global Recognition: With the CFP mark recognized in over 26 countries, your skills and expertise are valued worldwide. This global recognition provides you with the opportunity to extend your impact beyond local borders, making a difference on an international scale.

Taking the Next Step

Choosing to become a CFP professional is choosing a career of purpose, impact, and endless possibilities. It’s more than a career change—it’s about joining a community dedicated to enhancing financial well-being for individuals and families across the globe. At FPAM, we are here to support you every step of the way, offering resources, education, and networking opportunities to help you succeed in this dynamic and rewarding field. If you’re ready to elevate your career in financial planning, explore the possibilities with the CFP certification program. Embrace the opportunity to transform lives—including your own—by making a meaningful difference through the power of financial planning.