Why Foreign Currency Diversification Matters for Your Portfolio

March 11, 2025Stay Informed with FPAM Digest!

July 1, 2025By KP Bose Dasan

Tariffs are taxes imposed by one country on goods imported from another country. As trade barriers, tariffs generally raise prices, reduce available quantities of goods in the tariff-imposing country, and create economic burdens on foreign exporters. Economic perspectives on tariffs vary significantly among different schools of thought.

Classical economist Adam Smith, author of Wealth of Nations, viewed tariffs as government interference that distorted market efficiency and reduced overall wealth. However, Smith acknowledged exceptions for temporary tariffs to protect “infant industries” or for defence purposes.

John Maynard Keynes supported free trade in principle but recognised situations where tariffs might be necessary. Following the Great Depression, Keynes began supporting limited protectionism, particularly for maintaining full employment and economic stability. He believed that under certain macroeconomic conditions, such as high unemployment and weak demand, tariffs could help stimulate domestic production.

Malaysia’s Historical Experience with Tariffs

Malaysians experienced firsthand the effects of protective tariffs when the Proton Saga was launched by Tun Dr Mahathir Mohamad. High tariffs on imported cars made the Malaysian-made vehicle relatively cheaper than popular Japanese models, with consumers saving RM 5,000 to RM 10,000. However, this experience highlighted the importance of staying current with technology, design and features in manufacturing. Today, foreign investment has become essential, with Zhejiang Geely from China holding a 49.9% stake in DRB-Hicom, the local manufacturer.

The lesson for Malaysia and other countries is clear: maintaining competitiveness across all factors of production is essential. In today’s market, electric vehicles represent the future, with battery technology being the critical component.

Malaysia’s Trade Performance Analysis

To understand the potential impact of international tariff policies on Malaysia’s economy, it is essential to examine the country’s current trade patterns and performance indicators.

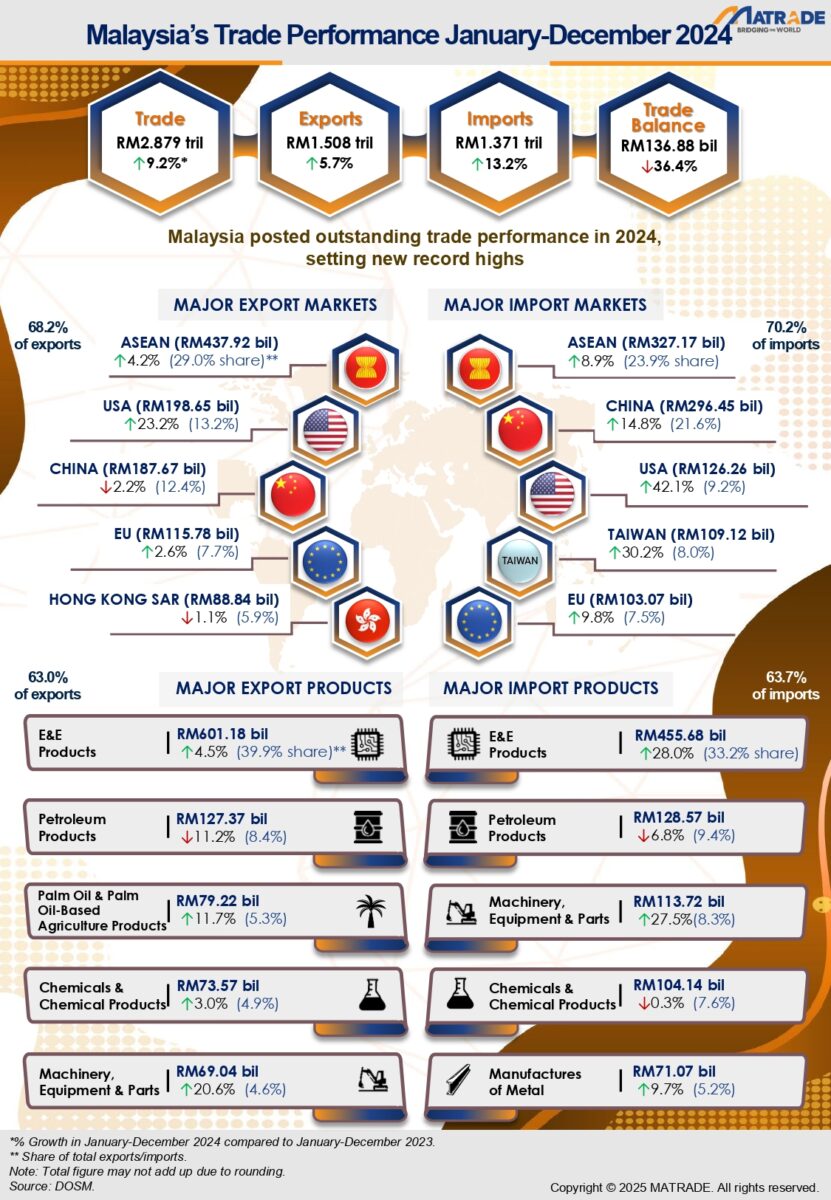

Credit: Matrade

Key Observations from 2024 Trade Data:

- Trade Balance: Malaysia’s trade surplus stands at RM 136.88 billion (RM 1.508 trillion in exports less RM 1.371 trillion in imports). When compared to the national budget of RM 421 billion for 2025, this represents a significant economic indicator requiring analysis.

- Trading Partners: Malaysia’s notable trading partners include China, the USA and ASEAN countries.

- Trade Composition: Electronics and petroleum products feature prominently in both exports and imports, indicating Malaysia’s role in global value chains through processing, assembly and value-added manufacturing activities.

Economic Analysis and Policy Considerations

Malaysia’s trade pattern suggests significant involvement in intermediate processing and assembly operations. While this provides employment and economic activity, there are opportunities to move up the value chain through:

- Enhanced domestic value addition by manufacturing more components locally, developing local brands or adding sophisticated services like design and engineering.

- Technology upgrading through adopting more advanced machinery, equipment and digital systems to improve production efficiency and product quality.

- Skills development by training the workforce to handle more sophisticated tasks and operate advanced technologies effectively.

- Innovation capacity building to develop Malaysia’s ability to create new products, services and solutions rather than just manufacturing existing designs.

Tariff Policy Implications

The potential implementation of a 24% tariff on Malaysian exports by the United States presents both challenges and opportunities. Malaysia’s response options include:

- Diplomatic engagement to seek exemptions or preferential treatment by negotiating with trading partners, highlighting Malaysia’s strategic importance and leveraging existing bilateral relationships.

- Diversification strategies to reduce dependence on any single market by expanding trade with emerging economies, developing new export destinations and creating alternative supply chains.

- Competitiveness enhancement through productivity improvements by streamlining operations, reducing costs and improving product quality to remain attractive despite tariff barriers.

- Regional cooperation through ASEAN and other trade agreements by strengthening collective bargaining power, harmonising standards and creating integrated regional value chains.

Structural Reform Priorities

Malaysia faces several structural challenges that require attention. The scale of public expenditure relative to trade surplus indicates the need for careful fiscal planning and efficient resource allocation. Improving labour productivity through education, training and technology adoption remains crucial for long-term competitiveness. Additionally, clear strategic direction is needed regarding export expansion versus import substitution policies, based on Malaysia’s comparative advantages.

Moving Forward

Malaysia’s economic future depends on its ability to transform from a cost-competitive assembler to an innovation-driven economy. This transformation requires sustained commitment to building domestic capabilities while maintaining competitiveness in global markets. Success will be measured not just by trade volumes but by the quality of economic activities and the resilience of Malaysia’s position in an increasingly complex global trade environment.

About the Writer

KP Bose Dasan, 73, holds an Economics degree from Universiti Malaya and an MBA from Cranfield University, but he values the education and experience he gained while working with the Inland Revenue Department Malaysia the most. Transitioning from a tax manager at Hanafiah Raslan Mohamad to running his own practice, he discovered that formal education alone isn’t enough, leading him to financial planning and eventually to a rewarding career in teaching.